Table of Contents

- The EV Financing Landscape: Why 2025 is a Game-Changer

- Market Trends Driving Favorable EV Loan Rates

- Your EV Financing Options: Where to Find the Best Deals

- 1. Credit Unions: The Unsung Heroes of EV Financing

- 2. Manufacturer Financing: Convenience with a Catch

- 3. Banks & Online Lenders

- Maximizing the $7,500 Federal Tax Credit in 2025

- The New Point-of-Sale Rebate System

- Who and What is Eligible?

- State & Local Incentives: The Secret to Supercharging Your Savings

- Top States for EV Rebates

- EV Loan Calculators: Don't Sign Without Doing the Math

- The Two Calculators You MUST Use

- Leasing vs. Buying an EV: The 2025 Decision Matrix

- When Leasing an EV Is a Smart Move ✅

- When Buying an EV Is Better ✅

- Step-by-Step Action Plan to Secure Your EV Loan

- Conclusion: Drive Electric, and Drive a Great Deal

Thinking about buying an electric car in 2025? You're not alone. The EV revolution is in full swing, but let's be honest: navigating the world of electric car financing, tax credits, and incentives can feel like trying to solve a puzzle in the dark. Between federal rule changes, state-specific rebates, and a growing list of "green loans," getting the best deal requires more than just a good credit score—it requires a solid strategy.

This is your definitive guide. Whether you’re eyeing a sporty Tesla, a practical Chevy Bolt, or a luxurious Rivian, we'll break down everything you need to know. We’ll help you secure the lowest EV loan rates, maximize every available tax credit, and confidently calculate the true cost of your new electric vehicle. Let's get you in the driver's seat of your dream EV without breaking the bank.

Key Takeaways for 2025:

- Point-of-Sale Credits: The $7,500 federal tax credit can now be applied as an instant discount at the dealership, slashing your upfront cost.

- Lower Interest Rates: Specialized "Green Loans" from credit unions and banks often feature APRs 0.25% to 0.75% lower than traditional auto loans.

- State Incentives Stack Up: Combining federal, state, and even local utility rebates can save you over $10,000 on your purchase.

- Total Cost is Key: An EV might have a higher sticker price, but lower fuel and maintenance costs can make it cheaper to own long-term.

The EV Financing Landscape: Why 2025 is a Game-Changer

The market for electric vehicle loans has matured rapidly. Gone are the days of lenders being hesitant about EV technology. Today, strong government support, fierce competition among automakers, and proven resale values have created a borrower's market. Understanding these trends is the first step to leveraging them for a better deal.

Market Trends Driving Favorable EV Loan Rates

Several key factors are making EV car finance more affordable than ever:

- Government Backing: The Inflation Reduction Act (IRA) has cemented EV tax credits through 2032, giving lenders long-term confidence in the market's stability. This reduces their risk, which translates to better rates for you.

- Automaker Competition: Legacy brands like Ford, GM, and Hyundai are offering aggressive, subsidized financing (as low as 0% APR on select models) to capture market share from Tesla and other EV-native companies.

- Higher Resale Values: As battery technology improves and charging infrastructure expands, EVs are holding their value better than many internal combustion engine (ICE) vehicles, making them a safer bet for lenders.

💡 Pro Tip: Always ask your lender if they offer a "Green Vehicle Loan" or an "EV Rate Discount." Many institutions offer these specialized products but don't always advertise them prominently. This simple question could lower your APR.

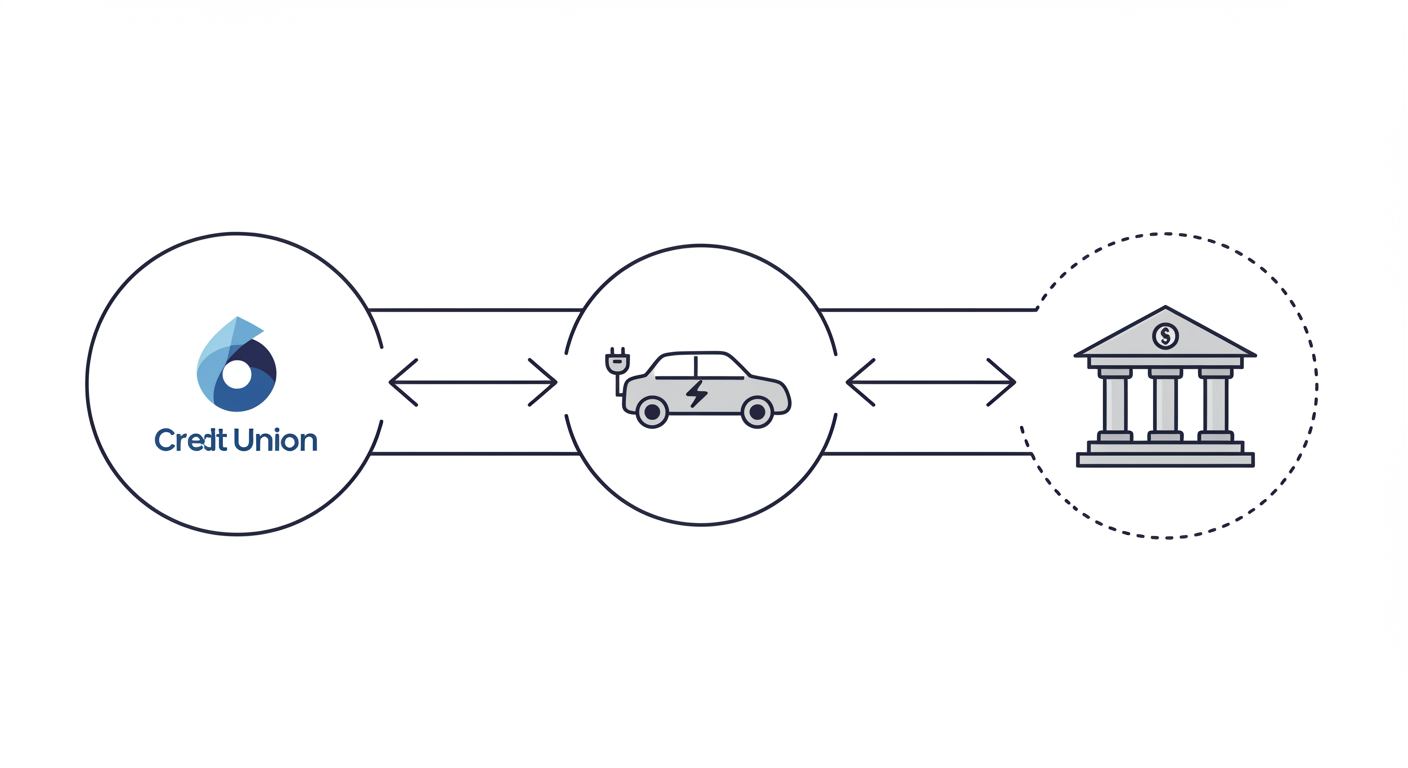

Your EV Financing Options: Where to Find the Best Deals

When it comes to securing an electric car loan, you have more options than ever. Don't just accept the first offer from the dealership—shopping around is critical.

1. Credit Unions: The Unsung Heroes of EV Financing

Credit unions are consistently leading the pack with the most competitive rates for EVs. As member-owned institutions, their profits are returned to members through better rates and lower fees.

- Top Performers: Look to credit unions like Navy Federal, PenFed, and Alliant, which often have dedicated green loan programs with rates starting below 5% APR for qualified borrowers.

- Membership: Don't assume you can't join. Many credit unions have broad eligibility requirements based on your location, employer, or even a small donation to a partner charity.

2. Manufacturer Financing: Convenience with a Catch

Financing directly through an automaker like Ford Credit or GM Financial can be incredibly convenient and sometimes offers unbeatable promotional rates (e.g., 0.9% or 1.9% APR).

- The Trade-Off: Often, you must choose between a low APR offer and a cash-back rebate. A loan from an outside lender might allow you to take the cash back, potentially saving you more overall. Always do the math.

3. Banks & Online Lenders

Traditional banks like Bank of America and Chase, along with online platforms, offer a wide range of auto loans. Their rates are competitive, especially if you are an existing customer with a strong banking history.

💰 Money-Saving Tip: Get pre-approved from at least two sources (e.g., your local credit union and a national bank) before you step into the dealership. This gives you a powerful negotiation tool and prevents you from being locked into a high-interest dealer loan.

Maximizing the $7,500 Federal Tax Credit in 2025

The federal EV tax credit is the single biggest incentive available, but its rules are complex. The biggest change is the ability to use it as an instant rebate at the dealership.

The New Point-of-Sale Rebate System

As of 2024, you no longer have to wait until tax season to claim your credit. If you and the vehicle qualify, you can transfer the credit to the dealer, and they will apply it directly to your purchase, effectively acting as a down payment of up to $7,500.

Who and What is Eligible?

Eligibility is tricky and depends on three key areas. Always verify the specific vehicle you are considering on the official IRS list.

- Vehicle Requirements:

- Final Assembly: Must be in North America.

- MSRP Cap: $55,000 for sedans/cars and $80,000 for SUVs, vans, and trucks.

- Battery & Mineral Sourcing: Strict, annually increasing requirements for where battery components and critical minerals are sourced. This is the most common reason a vehicle might not qualify for the full amount.

- Buyer Income Limits: Your Modified Adjusted Gross Income (MAGI) cannot exceed:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

⚡ Quick Check: Before you fall in love with a car, use the official U.S. Department of Energy's EV tax credit tool to confirm its eligibility. It's the most reliable source of information.

State & Local Incentives: The Secret to Supercharging Your Savings

Beyond the federal credit, many states, cities, and even utility companies offer their own rebates and incentives. These can be stacked for massive savings.

(Note: Programs change frequently. This list reflects common offerings, but check your local government websites for the latest details.)

Top States for EV Rebates

- California: The Clean Vehicle Rebate Project (CVRP) and Clean Cars 4 All offer thousands in additional rebates, especially for low- to moderate-income buyers.

- Colorado: Offers a generous state tax credit that can also be applied at the point of sale, just like the federal credit.

- New York, Massachusetts, and Oregon: All have robust rebate programs that can significantly lower your net purchase price.

🗺️ Location Tip: Don't forget your utility company! Many offer a one-time rebate of $500 or more for purchasing an EV or installing a home charger. Some also have special "time-of-use" electricity rates that make overnight charging incredibly cheap.

EV Loan Calculators: Don't Sign Without Doing the Math

A good financing decision is an informed one. Use calculators to understand the full financial picture beyond the monthly payment.

The Two Calculators You MUST Use

- Monthly Payment Calculator: This is the basic calculation to see if the payment fits your budget. The formula is:

Monthly Payment = [P × r × (1 + r)^n] / [(1 + r)^n - 1]Where P is the principal loan amount, r is the monthly interest rate, and n is the number of months.

- Total Cost of Ownership (TCO) Calculator: This is the most important one for EVs. It compares the long-term costs of an EV versus a gas car, including:

- Purchase price (after all credits and rebates)

- Financing interest

- Fuel (gas vs. electricity)

- Insurance

- Maintenance (EVs are typically 40% cheaper)

- Depreciation

💻 Tool Tip: Don't do this by hand! Use the comprehensive Loanyzer EV Financing Calculator. It's pre-loaded with federal and state incentives and lets you compare different loan scenarios side-by-side to find your optimal financing structure.

Leasing vs. Buying an EV: The 2025 Decision Matrix

With EV technology evolving so quickly, the age-old "lease vs. buy" debate is more relevant than ever.

When Leasing an EV Is a Smart Move ✅

Leasing is ideal if you prioritize lower monthly payments and always want the latest tech. A key advantage is that the leasing company claims the $7,500 federal tax credit and often passes the savings to you through a lower lease payment (called a "capitalized cost reduction").

- Best for: Tech enthusiasts, those who drive predictable, lower mileage (under 15,000 miles/year), and anyone concerned about long-term battery degradation.

When Buying an EV Is Better ✅

Buying makes sense if you plan to keep the vehicle for 5+ years and want to build equity. You have no mileage restrictions and can claim all the tax credits and rebates directly.

- Best for: High-mileage drivers, those who want to customize their vehicle, and anyone focused on the long-term investment value.

💡 Decision Framework: If the thought of outdated battery technology in 3 years makes you nervous, lease. If the thought of making car payments for years and having nothing to show for it bothers you, buy.

Step-by-Step Action Plan to Secure Your EV Loan

- Week 1: Budget & Credit Check. Determine your comfortable monthly payment and down payment. Check your credit score from a reputable source—this is the single biggest factor in your interest rate.

- Week 2: Research & Pre-Approval. Research specific EV models and confirm their incentive eligibility. Apply for pre-approval from your bank, a credit union, and one online lender to compare real offers.

- Week 3: Test Drive & Negotiate Price. With your pre-approval letter in hand, you're a "cash buyer" at the dealership. Test drive your top choices and negotiate the vehicle's price only, not the monthly payment.

- Week 4: Finalize Financing. Compare the dealership's financing offer (if any) to your pre-approvals. Choose the one with the lowest APR and best terms. Read the fine print before signing.

🚫 Avoid This Mistake: Never focus on the monthly payment alone. A dealer can hit any monthly payment target by extending the loan term to 84 or even 96 months. This dramatically increases the total interest you'll pay. Always compare loans based on APR and the total cost over the loan's life.

Conclusion: Drive Electric, and Drive a Great Deal

Financing an electric car in 2025 is more accessible and affordable than ever before, but securing the best deal requires a proactive approach. By understanding the interplay of federal credits, state rebates, and competitive loan products, you can turn a seemingly expensive purchase into a smart, long-term financial decision.

The key is preparation. Do your homework, shop for your loan as diligently as you shop for your car, and always look at the big picture—the total cost of ownership. The savings on fuel and maintenance are real and will continue to pay dividends long after your car is paid off.

🎯 Your Next Step: Ready to make your EV dream a reality? Use the Loanyzer EV financing comparison tool to get personalized rate quotes and see how incentives can lower your total cost. Take control of your financing journey today.