Table of Contents

- Your Quick Win Checklist: Top 3 Money-Saving Actions

- Phase 1 Your Pre-Game Strategy (Before you visit a dealer)

- 1. Become an Expert on Your Target Car

- 2. Get Pre-Approved for Financing (Your Superpower)

- 💡 Pro Tip: The Credit Union Advantage

- 3. Master Your Budget with the 20/4/10 Rule

- 4. Know Your Trade-In's Real Worth

- Phase 2 The Smart Hunt (Finding the right car at the right price)

- 5. Time Your Purchase for Peak Savings

- 6. Look Beyond New: Certified Pre-Owned (CPO) and Last Year's Model

- 7. Consider the Total Cost of Ownership (TCO)

- Phase 3 The Negotiation (Closing the Deal on Your Terms)

- 8. Shop the Deal, Not the Car

- 9. Negotiate Each Part Separately

- 10. Master the Art of Saying "No"

- 🚨 Fee Alert: The "Doc Fee"

- 11. Be Prepared to Walk Away

- 12. Read Every Single Word of the Contract

- Bonus Strategies for the Savvy Buyer

- 13. Look at Fleet and Former Rental Cars

- 14. Consider a Car Broker

- 15. Check for "Forgotten" Rebates

- Conclusion: Driving Home the Savings

- Ready to Start Your Journey?

Let's be real: buying a car can feel like stepping into a battle you’re not prepared for. Between sky-high sticker prices, confusing fees, and high-pressure sales tactics, it's easy to feel overwhelmed. As someone who's spent years under the hood of cars and deep in financing spreadsheets, I can tell you this: the difference between overpaying by thousands and driving away with a fantastic deal comes down to one thing—a smart game plan.

Forget the old, tired advice. In 2025, with a market still feeling the aftershocks of supply chain issues, you need a modern playbook. This guide is exactly that. We’re going to break down 15 battle-tested strategies that will put you in the driver's seat of the negotiation, saving you serious money and stress. Whether you're a first-time buyer or a seasoned pro, get ready to buy smarter.

Your Quick Win Checklist: Top 3 Money-Saving Actions

- Get Pre-Approved First: Secure a loan from your bank or a credit union before you shop. It’s the single most powerful negotiating tool you have.

- Time Your Attack: Shop at the end of the month, quarter, or model year. Sales quotas make dealers far more flexible.

- Negotiate Price, Not Payment: Always focus on the "out-the-door" price. Don't let talk of monthly payments distract you from the total cost.

Phase 1 Your Pre-Game Strategy (Before you visit a dealer)

The biggest savings are secured before you ever smell that new car scent. Preparation is everything.

1. Become an Expert on Your Target Car

Walking onto a lot without deep knowledge is like flying blind. You must know more than the salesperson about the car's real value.

- Find the True Market Value: Use tools like Kelley Blue Book (KBB) and Edmunds to find the fair purchase price for your desired trim in your area. This isn't the MSRP; it's what people are actually paying.

- Uncover the Invoice Price: This is roughly what the dealer paid for the car. Sites like Consumer Reports and Costco Auto Program can reveal this number. Your goal is to negotiate a price as close to the invoice as possible.

- Check Reliability Ratings: A cheap car that’s always in the shop is a money pit. Consult J.D. Power and Consumer Reports to ensure your choice is reliable long-term.

2. Get Pre-Approved for Financing (Your Superpower)

This is non-negotiable. Arranging your financing beforehand transforms you from a regular customer into a "cash buyer" in the dealer's eyes. It completely changes the power dynamic.

When you have your own check, you separate the car's price from the financing, preventing dealers from hiding profits in the interest rate. You can then confidently say, "I'm not interested in your financing, let's just talk about the price of the car."

Explore all your options. Should you go with a traditional bank or a modern online lender? Each has its pros and cons. We break it all down in our guide comparing car loans from Banks vs. Fintechs.

💡 Pro Tip: The Credit Union Advantage

Credit unions are non-profits, meaning they often offer significantly lower interest rates than big banks. If you're a member of one, start there. A 1-2% lower APR can save you over $1,000 in interest on a typical 5-year loan.

3. Master Your Budget with the 20/4/10 Rule

A smart budget prevents a new car from wrecking your financial health. Stick to the 20/4/10 rule as a guideline:

- 20% Down Payment: A healthy down payment minimizes your loan amount and helps you avoid being "upside down" (owing more than the car is worth).

- 4-Year (48 Month) Loan Term: While dealers will push 6 or 7-year loans to lower the monthly payment, you'll pay far more in interest. Aim for the shortest term you can comfortably afford.

- 10% of Monthly Income: Your total car expenses (payment, insurance, fuel) shouldn't exceed 10% of your gross monthly income.

Want to see exactly how different loan terms and down payments will impact your budget? Play with the numbers using our comprehensive Car Loan Calculator before you commit.

4. Know Your Trade-In's Real Worth

Dealers love to undervalue trade-ins. Get an independent valuation before you talk to them. Get instant online offers from services like Carvana, Vroom, and CarMax. This gives you a hard number—a baseline offer you know you can get. Now, you can challenge a dealer's lowball offer or simply sell it to one of these services for more money.

Phase 2 The Smart Hunt (Finding the right car at the right price)

With your research done, it's time to find the actual vehicle.

5. Time Your Purchase for Peak Savings

Dealerships have quotas. Use this to your advantage. The best times to buy are:

- End of the Month/Quarter: Sales managers are desperate to hit their numbers and are more likely to approve aggressive discounts.

- End of the Model Year (Aug-Oct): They need to clear out last year's models to make room for the new ones. You can often get huge discounts on a brand-new "old" model.

- Holidays: Black Friday and other major holiday weekends often feature manufacturer rebates.

6. Look Beyond New: Certified Pre-Owned (CPO) and Last Year's Model

A brand-new car loses ~20% of its value in the first year. Let someone else pay for that depreciation.

- Certified Pre-Owned (CPO): These are the gold standard of used cars. They're typically low-mileage, late-model vehicles that have passed a rigorous inspection and come with a manufacturer-backed warranty. You get near-new quality for a used-car price.

- The "Leftover" New Car: Buying last year's model year can instantly save you 10-15% off MSRP for a car that is often identical to the brand-new version.

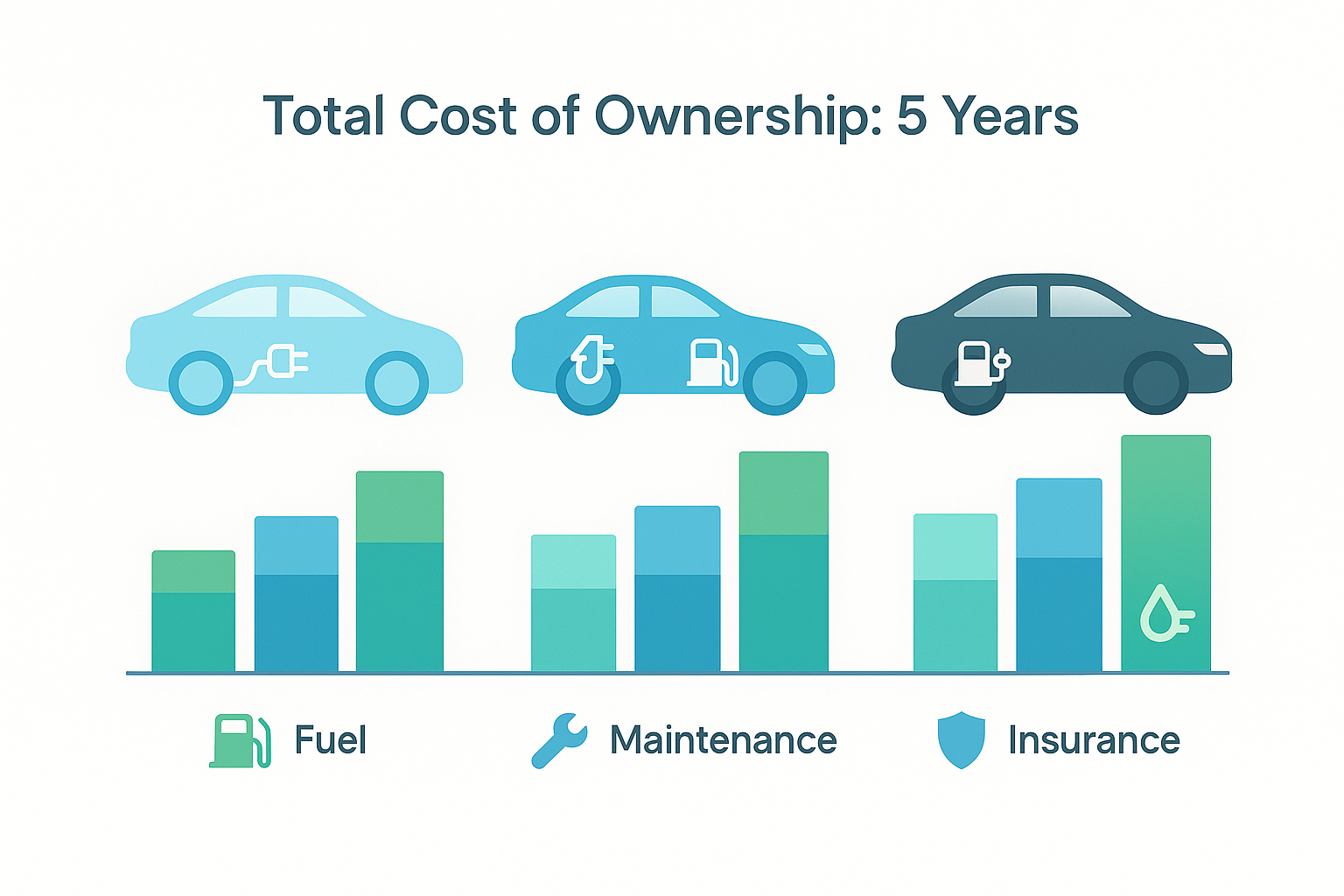

7. Consider the Total Cost of Ownership (TCO)

The sticker price is just the beginning. A cheaper car could cost you more over time. Consider:

- Fuel Costs: This is where electric vehicles can be a huge long-term win. While the initial purchase price might be higher, the savings on gas and maintenance can be massive. Explore your options with our guide to electric vehicle financing.

- Insurance Rates: A sporty coupe costs more to insure than a family sedan. Get insurance quotes for your top choices before you buy.

- Maintenance & Repairs: German luxury cars are fantastic, but their repair bills are legendary. A Toyota or Honda will almost always be cheaper to maintain.

Phase 3 The Negotiation (Closing the Deal on Your Terms)

This is where your preparation pays off. Stay calm, be patient, and stick to the plan.

8. Shop the Deal, Not the Car

Once you've chosen your model, contact multiple dealerships' internet sales departments. Email them with a clear request: "I am interested in a [Year, Make, Model, Trim]. Please provide your best out-the-door price." This forces them to compete for your business and gets you a written offer, avoiding showroom games.

9. Negotiate Each Part Separately

The dealer wants to lump everything together to confuse you. Your job is to separate it into three distinct transactions:

- The price of the new car.

- The value of your trade-in.

- The financing (which you already have, but you can see if they can beat it).

Finalize the price of the new car before you even mention a trade-in.

10. Master the Art of Saying "No"

When you get to the finance office, you'll be offered a menu of extras: extended warranties, paint protection, VIN etching, etc. These are almost always overpriced and unnecessary. Politely but firmly decline them. A simple "No, thank you" is all you need.

🚨 Fee Alert: The "Doc Fee"

The Documentation Fee is one of the few fees that is often non-negotiable, but its amount can vary wildly. Some states cap it, while others don't. While you might not be able to remove it, if a dealer has a very high doc fee ($500+), you can demand they lower the car's sale price to compensate.

11. Be Prepared to Walk Away

Your greatest power is your ability to leave. If the numbers aren't right or you feel pressured, simply stand up, thank them for their time, and walk out. More often than not, your phone will ring with a better offer before you even get home.

12. Read Every Single Word of the Contract

Take your time in the finance office. Ensure all the numbers on the final contract match what you agreed upon. Check the vehicle price, trade-in value, loan APR, and term. Do not let them rush you through this final, critical step.

Bonus Strategies for the Savvy Buyer

13. Look at Fleet and Former Rental Cars

Companies like Hertz and Enterprise sell their used rental cars directly to the public. These cars are typically only 1-2 years old, have been regularly maintained, and are sold at no-haggle prices well below market value.

14. Consider a Car Broker

If you detest negotiating, a car broker can be worth the fee. They leverage their industry connections and volume to get a price you likely couldn't achieve on your own, handling the entire process for you.

15. Check for "Forgotten" Rebates

Always ask if you qualify for special rebates. Automakers often have unadvertised discounts for recent college graduates, military members (active or veteran), or members of certain organizations (like USAA or even some credit unions).

Conclusion: Driving Home the Savings

Saving money when buying a car isn't about luck; it's about following a disciplined process. By preparing thoroughly, staying patient, and negotiating from a position of strength, you can turn one of life's most expensive purchases into a moment of financial victory.

Remember the fundamentals: research is your shield, pre-approved financing is your sword, and your ability to walk away is your ultimate power. You are in control.

Ready to Start Your Journey?

Empower your car-buying process with the right tools. Use the Loanyzer platform to compare financing offers and calculate your true costs. A smart purchase starts with smart financing. Drive home a deal you can be proud of.